401k Limits 2025 Total Income. Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov. For those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.

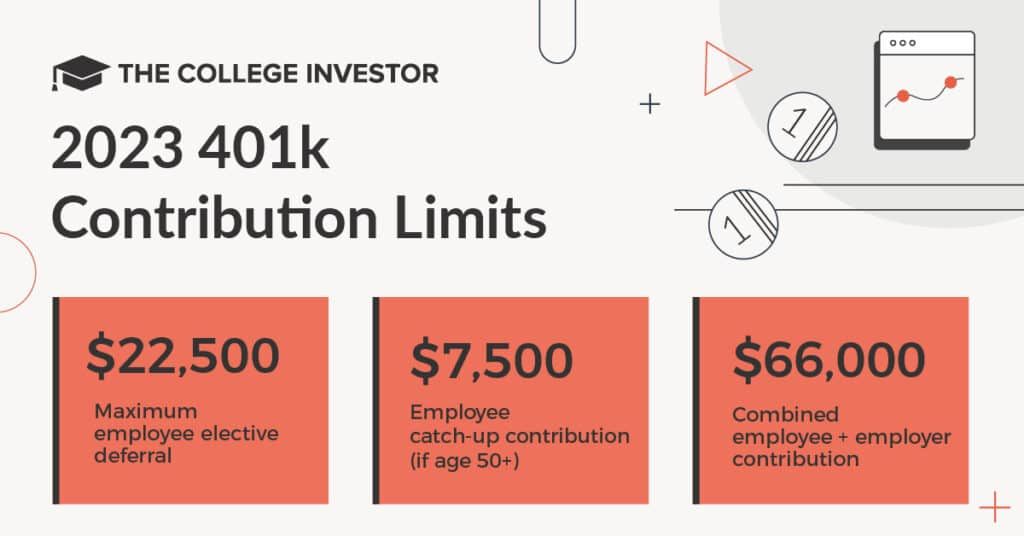

Workplace retirement plan contribution limits for 2025. The 2025 401(k) individual contribution limit is $23,000, up from $22,500 in 2025.

401k Limit For 2025 With Catch Up Contributions 2025 Kacie Maribel, The total contribution limit, including employer.

Contribution Limits 2025 Multiple Ira Withdrawals Dion Myrtie, Those 50 and older can contribute an additional $7,500.

Total 401 K Contribution Limit 2025 Over 55 Moyna Rebeca, Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov.

401k Contribution Limits 2025 Catch Up Total Assets Prudi Carlotta, The 2025 contribution limit for 401 (k) plans is $23,000, up from $22,500 in 2025.

401k Contribution Limits 2025 Catch Up Total Penni Blakeley, That's an increase from the 2025 limit of $330,000.

Max 401k 2025 For 55 Years Old Woman Jody Magdalena, For 2025, the 401(k) limit for employee salary deferrals is $23,000, which is above the 2025 401(k) limit of $22,500.